Aatmanirbhar Bharat Abhiyan 3.0

EPF Scheme incentives benefits for Employers and Employees by the Government

New Incentives for Businesses covered in PF (Provident Fund) to boost Employment

If an establishment has less than 1000 employees, 24% PF (12% Employees share and 12% Employers share) shall be paid by the Government for their new employees employed on or after 01.10.2020.

This benefit shall be for a period of two years from the date of employment

If employees are more than 1000, then only 12% Employees share shall be paid by the Government. Employer continues to pay their 12% share.

Conditions:

• Scheme is for employees with monthly wages less than Rs.15,000/-

• If establishment has less than 50 employees, minimum 2 new employees be added.

• If you have more than 50 employees, you should employ minimum 5 or more new.

• New means, First time PF Registration, on or after 01.10.2020

• Also, if any old employee lost or left job between 01.03.2020 to 30.09.2020, then on re-employment after 1.10.20 he shall get the benefit.

• Businesses which are not yet covered in PF but do so now shall get the benefit for ALL their employees.

• Scheme open till 30.06.2021

Benefits:

• This is huge incentive by the Government to encourage businesses to add new employees and also to establishments not yet registered with EPFO to do so.

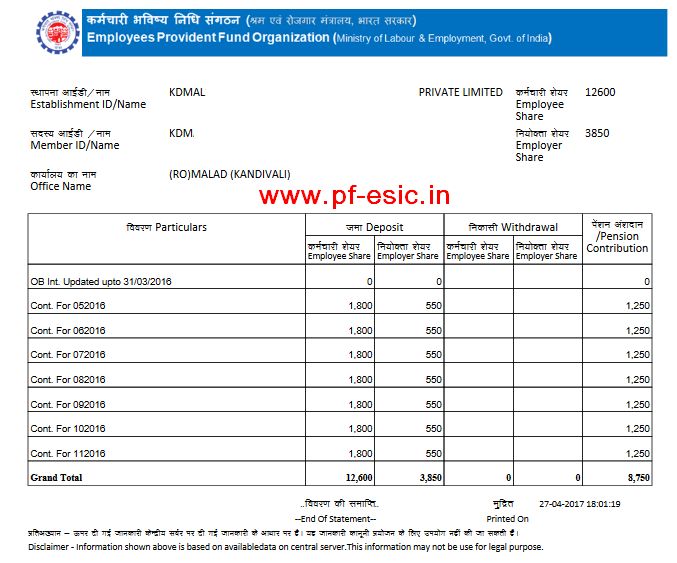

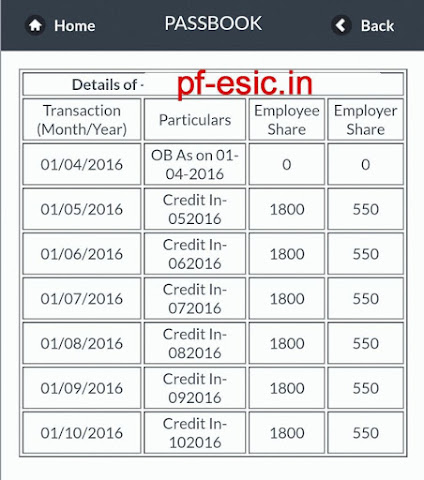

• Example, if an employee is at 14,999/- then Rs.1800/- (12% employee share) and Rs.1800/- (12% employer share), total Rs.3600/- per month shall be paid by the Government for 2 years

• Total of 3600X24= Rs.86,400.

• Both Employer and Employee get benefit of upto Rs.43,200/- each year in 2 years.

• It means PF shall not be deducted from new eligible employees.

• Ironically, it means that New eligible employees get Rs.1800/- per month more than existing old employees presently drawing less than Rs.15,000/- wages per month, for 2 years.

• It also means that Employees who left on or after 01.03.2020 and rejoin after 01.10.2020 shall get this incentive of upto Rs.1800/- pm but if any loyal employee stayed back and continued to work or joined before 01.10.2020 shall not be eligible for this benefit.

• nonetheless It is a grand incentive for new businesses that employ 20 or more employees on or before 30th June 2021.

• It’s also a grand incentive for existing businesses not yet covered in PF (employees less than 20) or those who have avoided or evaded PF registration. Till now enforcement department of PF would not only recover old PF dues, they would also recover interest and penalty. But now, there’s this huge incentive for such units to get voluntarily covered in PF.

Example:

Suppose one is able to adds 20 employees, it will mean benefit of upto Rs.43,200 X 20 X 2= Rs.17,28,000/- in 2 years.

And for new employees that one adds till 30.06.2021, each employee shall get additional benefit of Rs.43,200/- per year.

The employees can also get benefit of 24% of basic wages upto Rs.3600/- per month as this amount shall be deposited in their PF account by the Government for 2 years.